KRUNGSRI LEASING

Leasing / Hire Purchase

Financial Lease

- Financial lease provides the option for lessee to buy the leased assets at the agreed price (Option price/Residual value) in the lease contract to extend the lease contract after expiration of contract upon company's consideration.

- Suitable for juristic person who wants to gain more tax benefits due to the whole amount of lease payment is tax deductible expense.

Hire Purchase

- The ownership of asset will transfer to the Hire Purchaser at the end of contract.

- Suitable for juristic person who wants to have their name as the possessor in the registration book such as construction contractor, transportation operator, etc. Government agencies classification or the business owner who wants 1-5 years financing term.

Sale and Lease Back/Hire Purchase Back

- The Leassee / Hire Purchaser can sell their freehold assets to Krungsri Leasing and then lease the assets back for their own use.

- Suitable for juristic person who wants to increase their working capital in order to enhance business liquidity or in case they buy the assets by cash before applying for credit facilities with Krungsri Leasing.

Benefits of Leasing & Hire Purchase

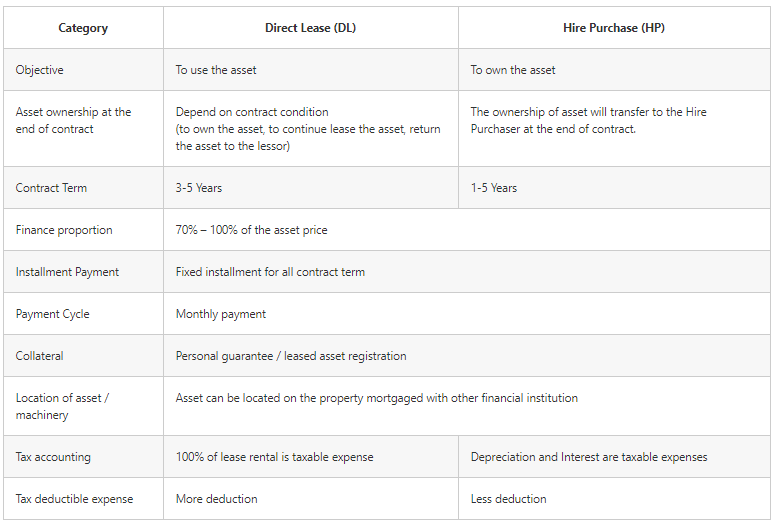

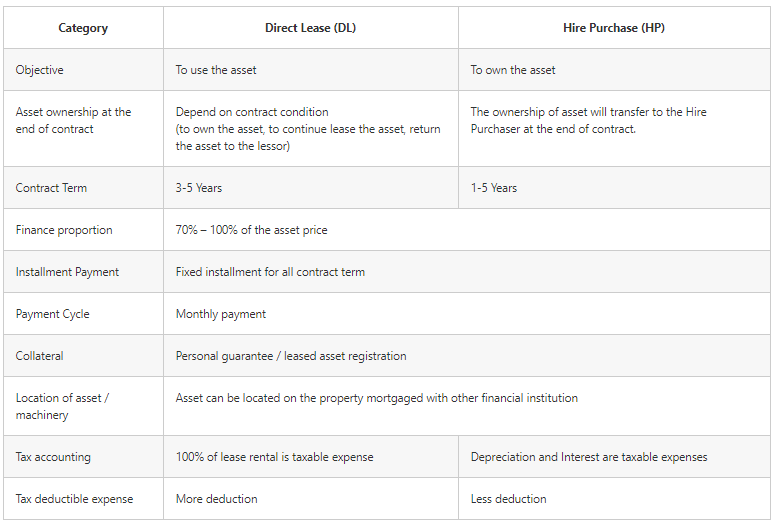

The Difference of Leasing & Hire Purchase